- Getting Started

- My Plan

- Personalization

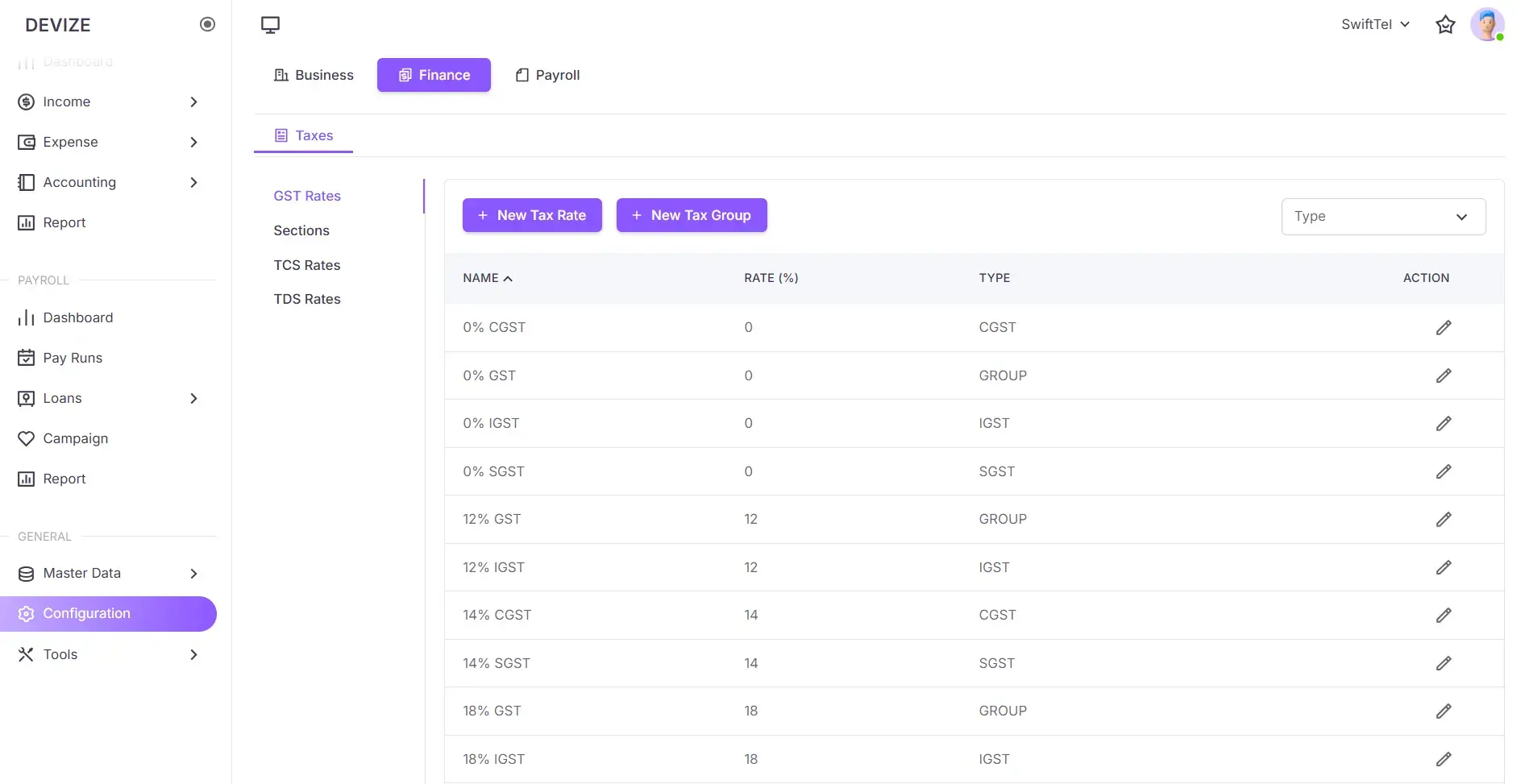

Setup Taxes

Taxes in the Finance module refer to the different tax rates, rules, and configurations businesses need to comply with when processing invoices, expenses, and financial transactions. These include GST, TCS, and TDS, among others.

Create a GST Rate

A GST (Goods and Services Tax) rate is a percentage of tax applied to goods and services based on tax regulations. Businesses must define and apply appropriate tax rates to their transactions.

- Navigate to Configuration: Select Configuration from the sidebar menu.

- Go to Finance: Select the Finance tab and navigate to Taxes .

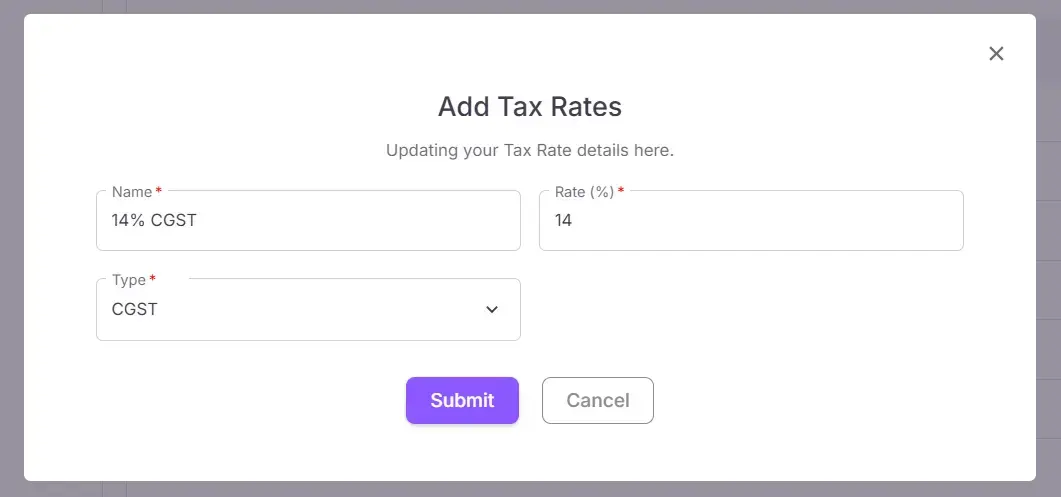

- Create a New Tax Rate: Click on the New Tax Rate button. A popup form will appear.

- Fill in the Required Fields: Enter the tax rate details such as Name , Rate (%) , and Type .

- Save the Tax Rate: Click Save to add the new GST rate.

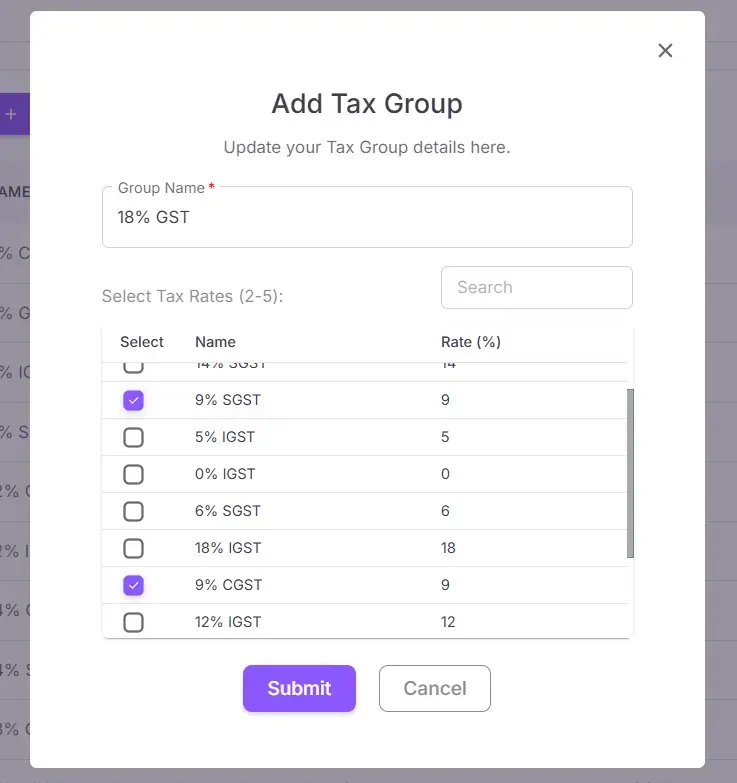

Create a Tax Group

A tax group is a collection of multiple tax rates applied together on transactions. It allows businesses to manage tax calculations efficiently by grouping related taxes under a single entity.

- Navigate to Taxes: Go to the Taxes section under the Finance tab.

- Click on New Tax Group: Click the New Tax Group button to open the form.

- Enter Group Details: Provide a name for the tax group and select tax rates .

- Save the Tax Group: Click Save to add the new tax group.

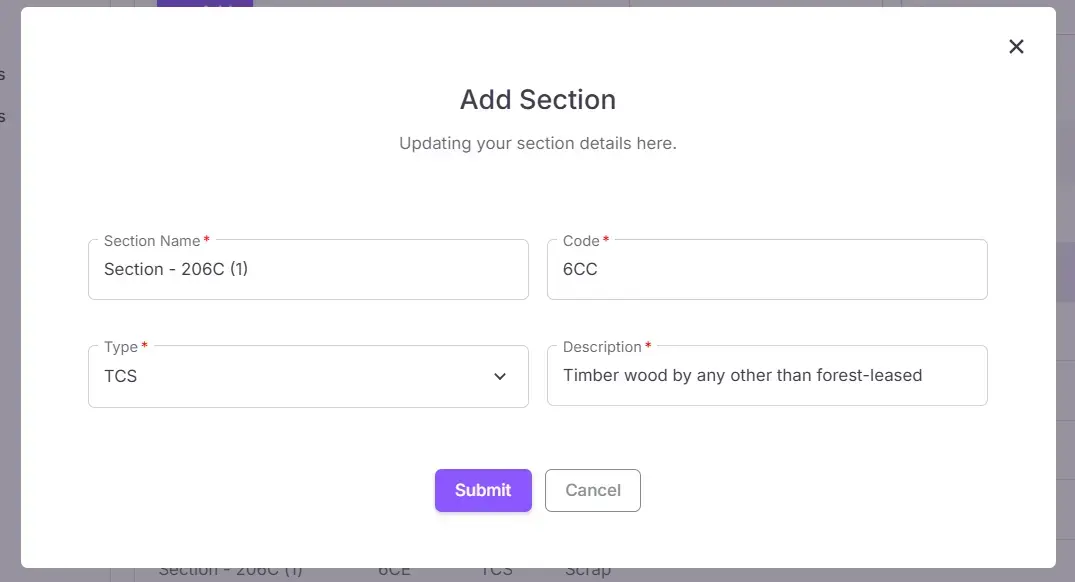

Create a Section

Sections help categorize and manage financial details like TDS (Tax Deducted at Source) and TCS (Tax Collected at Source). Users can add sections with specific codes and descriptions to streamline tax compliance and reporting.

- Navigate to Configuration: Select Configuration from the sidebar menu.

- Go to Finance: Select the Finance tab and navigate to Sections .

- Click on Add: Click the Add button to open the form.

- Fill in the Required Fields: Enter details such as Section Name , Code , Type (TCS/TDS) , and Description .

- Save the Section: Click Save to add the new section.

Create a TCS or TDS Rate

TCS (Tax Collected at Source) and TDS (Tax Deducted at Source) rates determine the tax percentage applicable on specified transactions. Businesses use these rates to ensure proper tax compliance and reporting.

- Navigate to Configuration: Select Configuration from the sidebar menu.

- Go to Finance: Select the Finance tab and navigate to TCS or TDS Rates .

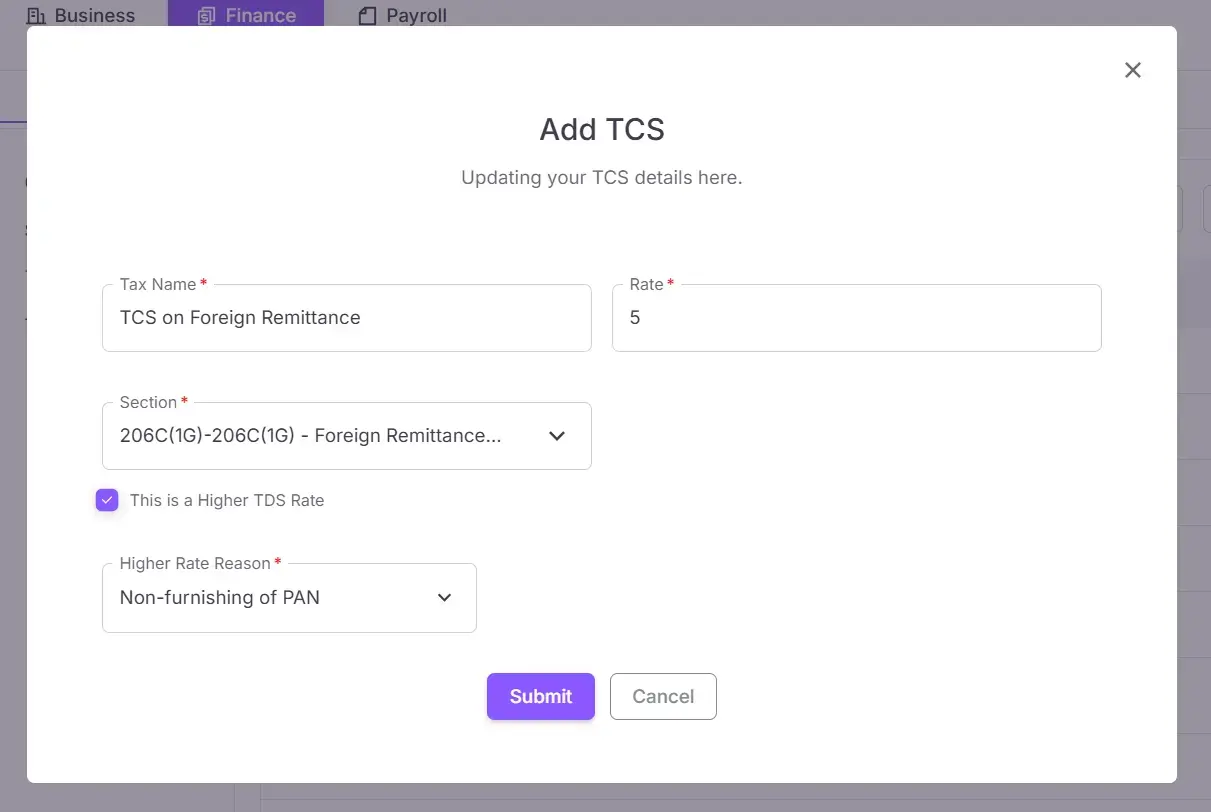

- Click on Add: Click the Add button to open the form.

- Fill in the Required Fields: Enter details such as Tax Name , Rate , and Section .

- Enable Higher TDS Rate (if applicable): Check the box and select a reason from the dropdown.

- Save the TCS or TDS Rate: Click Save to finalize the new tax rate.

| Name | Description |

|---|---|

| Name | The name of the tax rate |

| Group Name | The name of the tax group |

| Rate (%) | The percentage of tax applied. |

| Type | The type of tax (e.g., CESS, CGST, IGST, SGST, UTGST). |

| CESS | Cess is a tax on tax, usually imposed for specific purposes like education or infrastructure. |

| CGST | Central Goods and Services Tax is levied by the central government on intra-state sales. |

| IGST | Integrated Goods and Services Tax is charged on inter-state transactions and collected by the central government. |

| SGST | State Goods and Services Tax is levied by state governments on intra-state sales. |

| UTGST | Union Territory Goods and Services Tax is applicable in Union Territories in place of SGST. |