Documents

- Getting Started

- My Plan

- Personalization

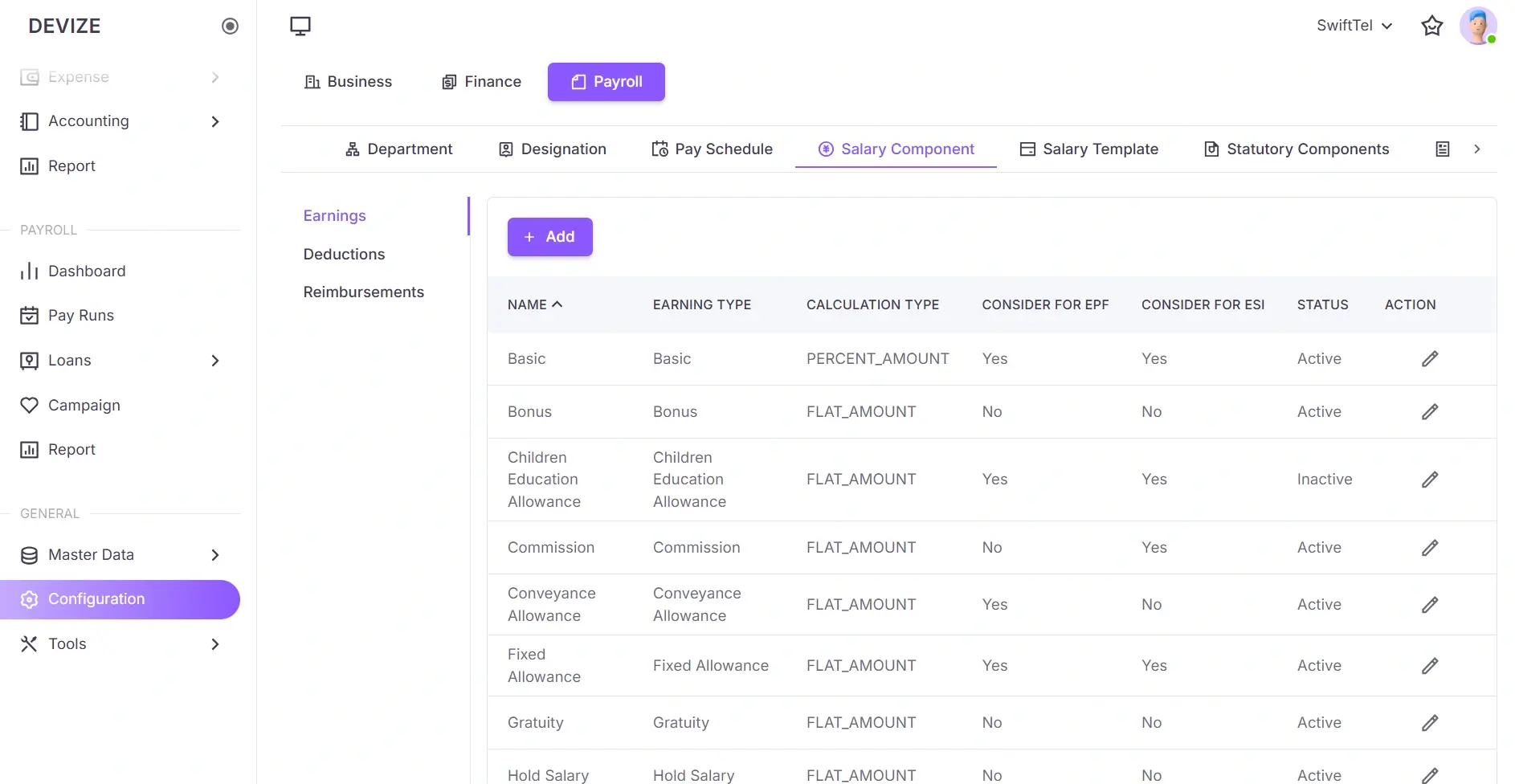

Setup Salary Component

A salary component refers to any individual element that makes up an employee's total compensation, including earnings (e.g., basic salary, bonuses, and allowances), pre-tax deductions (e.g., provident fund, retirement contributions), post-tax deductions (e.g., loan repayments, union fees), and reimbursements (e.g., travel, medical, and meal expenses). Proper configuration ensures accurate payroll processing and compliance with regulations.

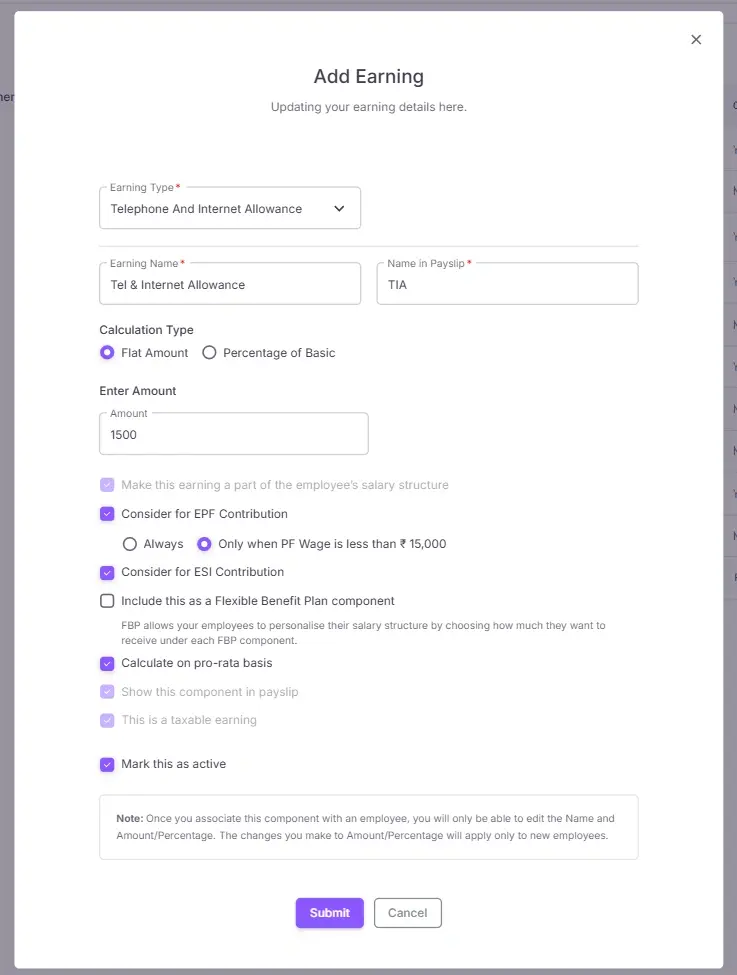

Create an Earning

Follow these steps to create an earning:

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Salary Component Tab: Click the Salary Component tab to configure salary-related settings.

- Select Earning from the Sidebar: In the Salary Component section, select Earning from the sidebar to proceed with creating an earning.

- Add New Earning: Click the Add button and enter details.

Note

Other configurations will be visible based on the selected Earning Type.

| Name | Description |

|---|---|

| Earning Type | Select the type of earning from the dropdown. |

| Earning Name | Provide a name for the earning component. |

| Name in Payslip | Specify how this earning appears on payslips. |

| Calculation Type | Choose between a flat amount or a percentage-based calculation. |

| Enter Amount | Specify the earning amount. |

| Enter Percentage | Specify the earing percentage. |

| Mark this as active | Toggle whether this earning is currently active. |

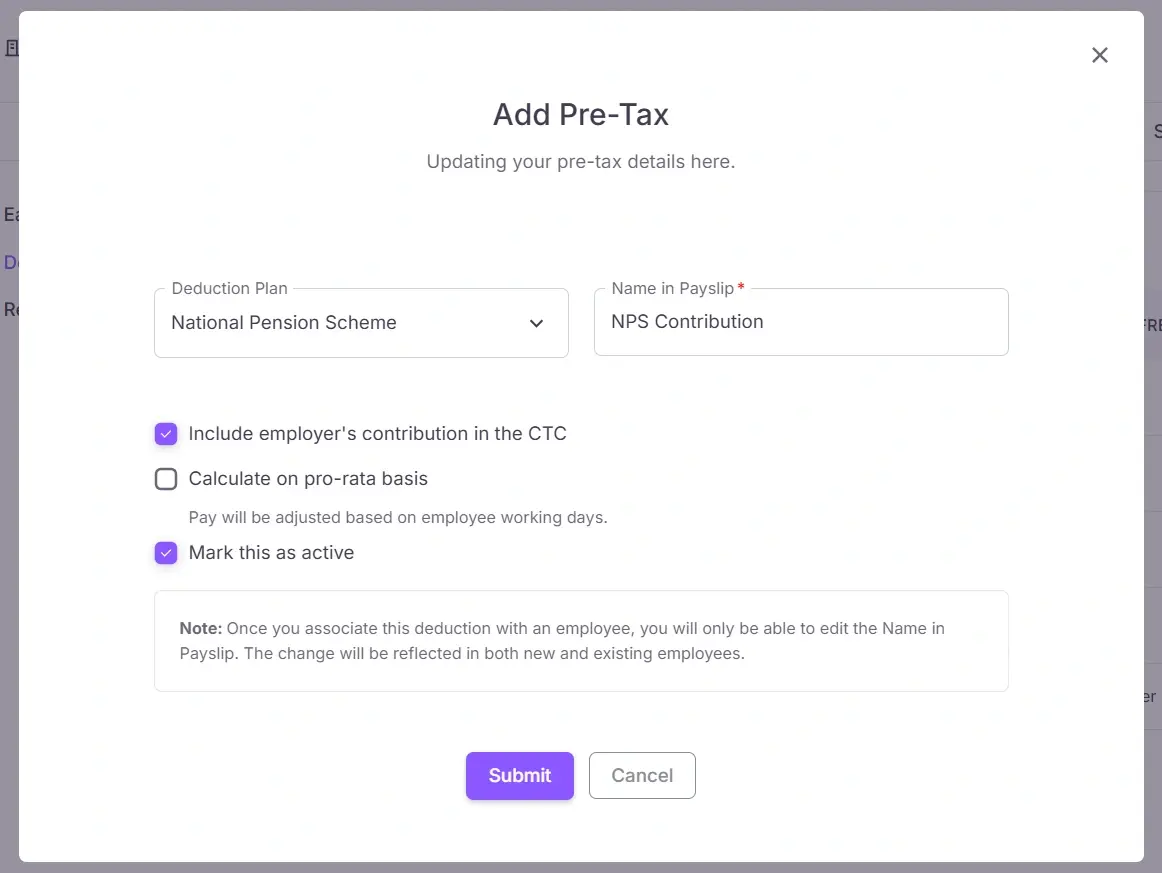

Create a Pre-Tax Deduction

Follow these steps to create a pre-tax deduction:

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Salary Component Tab: Click the Salary Component tab to configure salary-related settings.

- Select Deductions from the Sidebar: In the Salary Component section, select Deductions from the sidebar to navigate to the deductions page.

- Add New Pre-Tax Deduction: Click the Add Pre-Tax Deduction button and enter deduction details.

| Name | Description |

|---|---|

| Deduction Plan | Select the deduction plan from the dropdown. |

| Name in Payslip | Specify how this deduction appears on payslips. |

| Include employer's contribution in the CTC | Toggle whether the employer’s contribution is included in the Cost to Company. |

| Calculate on pro-rata basis | Enable this to adjust pay based on employee working days. |

| Mark this as active | Toggle whether this deduction is currently active. |

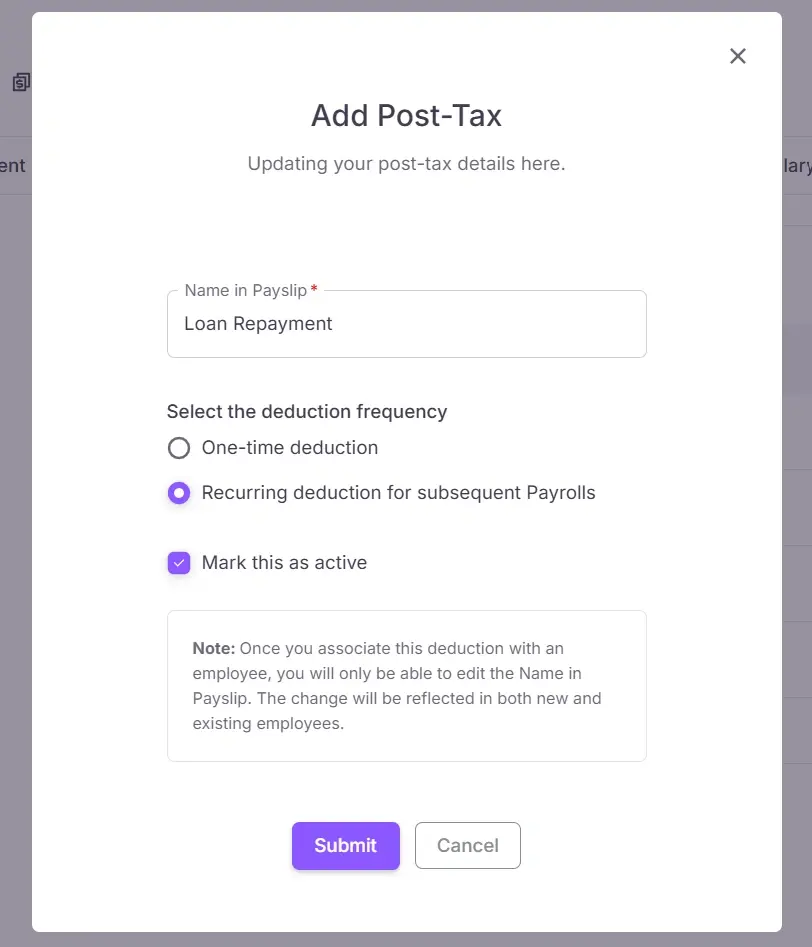

Create a Post-Tax Deduction

Follow these steps to create a post-tax deduction:

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Salary Component Tab: Click the Salary Component tab to configure salary-related settings.

- Select Deductions from the Sidebar: In the Salary Component, select Deductions from the sidebar to navigate to the deductions page.

- Add New Post-Tax Deduction: Click the Add Post-Tax Deduction button and enter deduction details.

| Name | Description |

|---|---|

| Name in Payslip | Specify how this deduction appears on payslips. |

| Deduction Frequency | Choose between a one-time deduction or a recurring deduction. |

| Mark this as active | Toggle whether this deduction is currently active. |

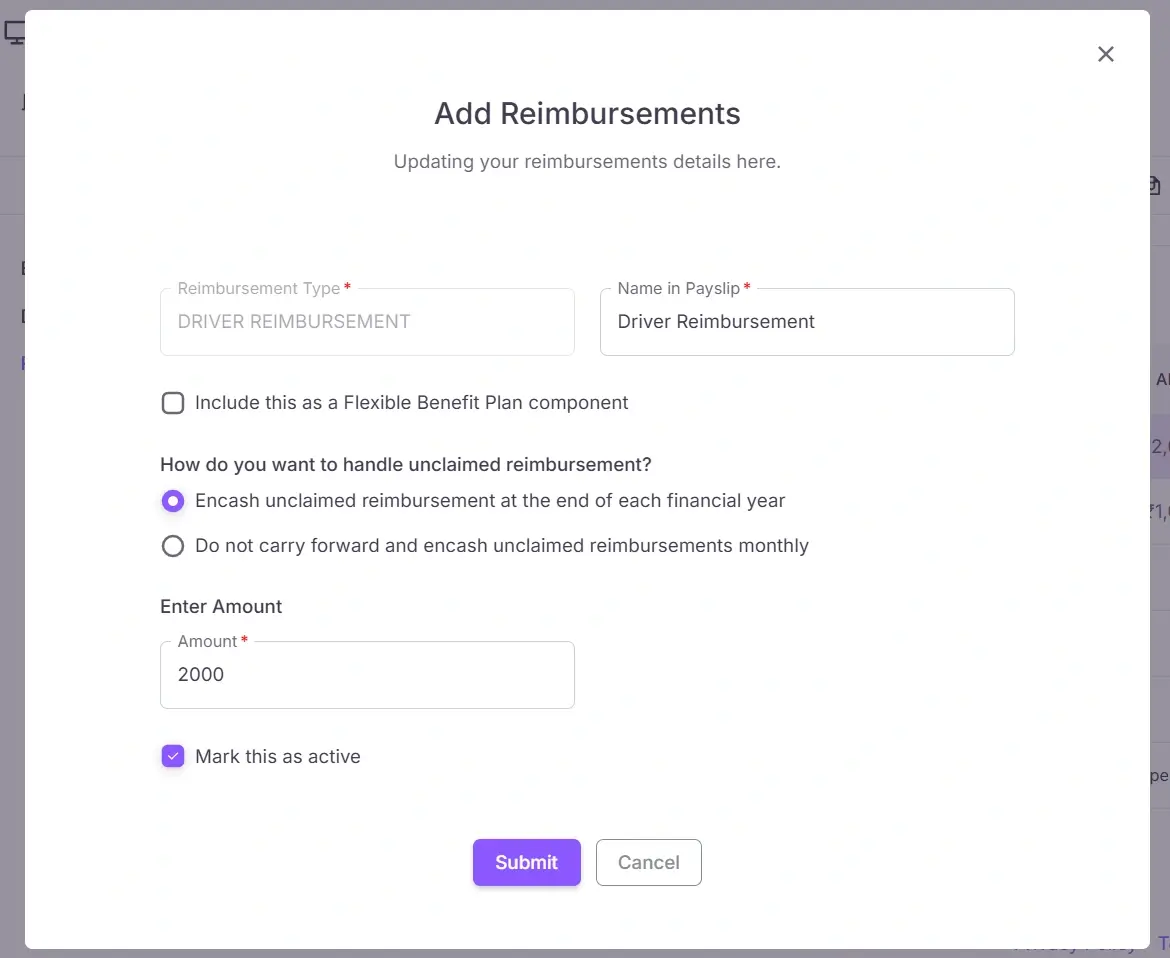

Create a Reimbursement

Follow these steps to create a reimbursement:

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Salary Component Tab: Click the Salary Component tab to configure salary-related settings.

- Select Reimbursement from the Sidebar: In the Salary Component, select Reimbursement from the sidebar to configure reimbursements.

- Add New Reimbursement: Click the Add button and enter reimbursement details.

| Name | Description |

|---|---|

| Reimbursement Type | Select the type of reimbursement from the dropdown. |

| Name in Payslip | Specify how this reimbursement appears on payslips. |

| Include this as a Flexible Benefit Plan component | Toggle whether this reimbursement is part of a Flexible Benefit Plan. |

| Encash unclaimed reimbursement at the end of each financial year | Select this option to encash any unclaimed reimbursement at the end of the financial year. |

| Do not carry forward and encash unclaimed reimbursements monthly | Select this option to encash unclaimed reimbursements on a monthly basis. |

| Enter Amount | Specify the reimbursement amount. |

| Mark this as active | Toggle whether this reimbursement is currently active. |