- Getting Started

- My Plan

- Personalization

Setup Statutory Components

Configure statutory salary components like EPF, ESI, LWF, PT, and SB to ensure compliance with regulations.

Employee Provident Fund (EPF)

EPF is a retirement benefits scheme where both employer and employee contribute a fixed percentage.

Guidelines for EPF

Rules and contributions applicable to EPF compliance.

- Employers must contribute 12% of basic salary , and employees must also contribute 12% .

- Employees can voluntarily contribute more than 12% , but the employer is not obligated to match the extra amount.

- EPF contributions are tax-exempt under Section 80C of the Income Tax Act .

- The employer’s contribution is divided into 8.33% towards EPS and 3.67% towards EPF .

- Employees can withdraw their EPF balance under specific conditions like retirement, unemployment, or emergencies .

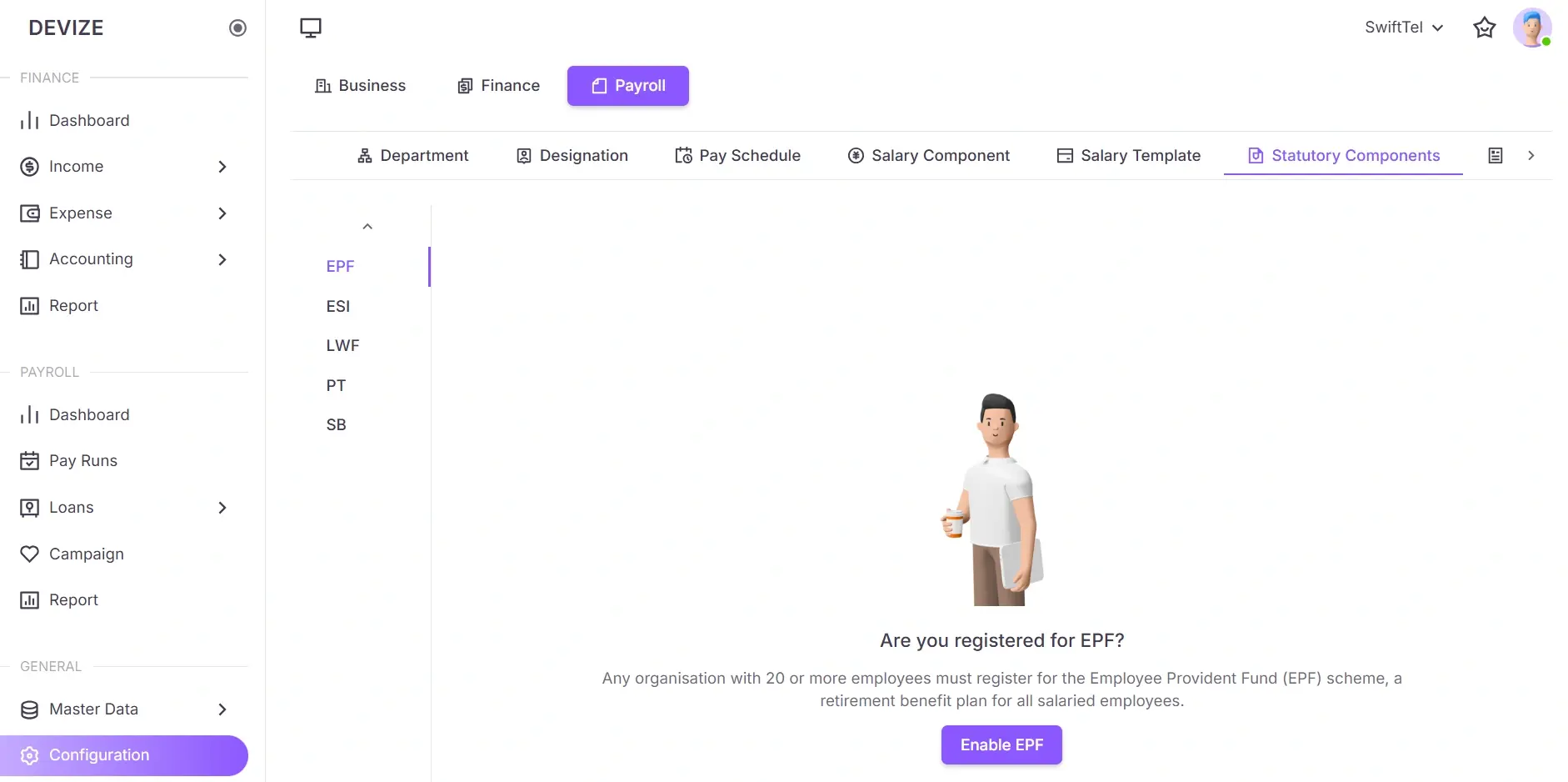

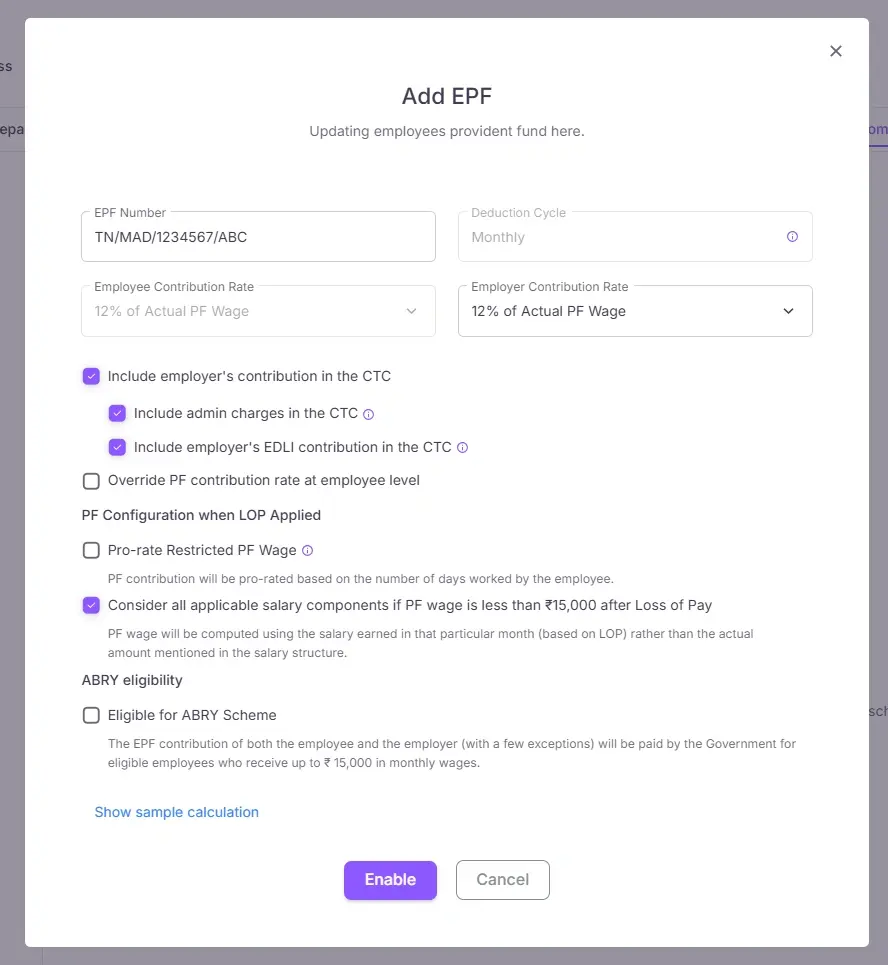

Setup EPF

Steps to enable EPF in payroll settings.

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Statutory Component Tab: Click the Statutory Component tab and select EPF from the sidebar.

- Enter your EPF Number: You can find this in the registration letter which you received from the Employee Provident Fund Organisation (EPFO).

- Include Employer’s Contribution in CTC: Select whether you want to include the employer’s contribution as a part of employees’ CTC.

- Restrict Overriding of PF Contribution Rate: If you want to restrict the overriding of the PF contribution rate at the employee level, check the respective option.

- Restrict Employer’s Contribution Calculation: Select whether you want to restrict employer’s contribution calculation to ₹15,000 of Basic Pay. If you enable this option, employer’s contribution will be calculated only for ₹15,000, even if the Basic Pay exceeds that amount.

- Include Other PF Components if Basic Pay is Less than ₹15,000: If the Basic Pay is less than ₹15,000, other PF components such as Travelling Allowance and Telephone Allowance may be included in the PF wage computation to bring the EPF to ₹15,000. To enable this, check the option Consider all applicable PF components if PF wage is less than ₹15,000 after Loss of Pay.

- Enable ABRY Scheme: Check the box next to Eligible for ABRY Scheme , if your organisation is registered for the ABRY scheme.

- Select Contribution Type: Check the appropriate Contribution Type: Only Employee or Both Employee and Employer.

- Enable EPF: Click the Enable button to enable EPF.

Employee State Insurance (ESI)

ESI provides medical and disability benefits to employees earning below a specific wage threshold.

Guidelines for ESI

Details on ESI contribution and eligibility.

- Employers contribute 3.25% and employees contribute 0.75% of gross salary.

- ESI covers employees earning up to ₹21,000 per month ( ₹25,000 for persons with disabilities ).

- The scheme provides medical, maternity, disability, and dependent benefits .

- ESI contributions are mandatory for establishments with 10 or more employees ( 20 in some states ).

- Employees can avail of benefits from ESI hospitals and dispensaries across India.

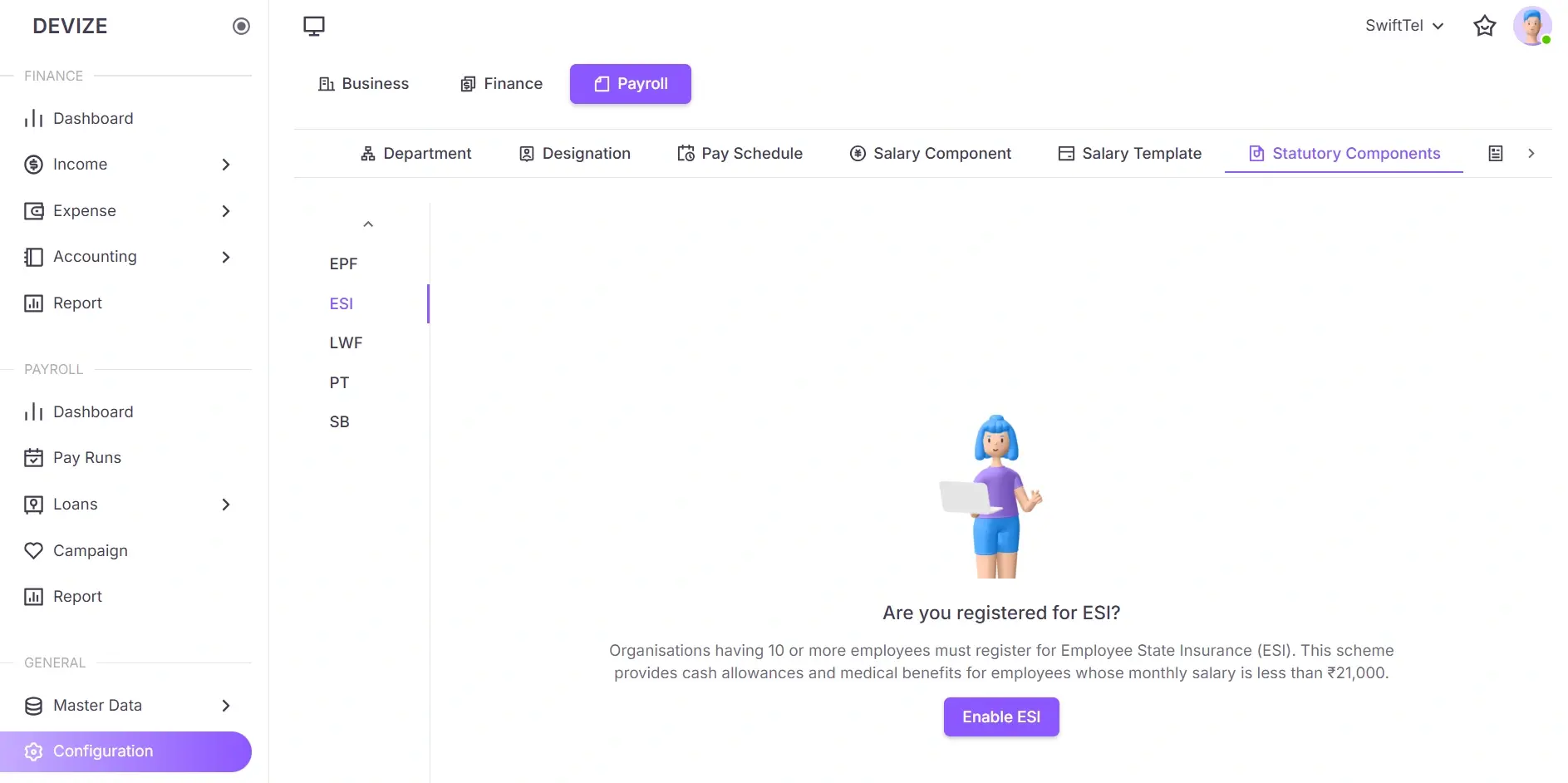

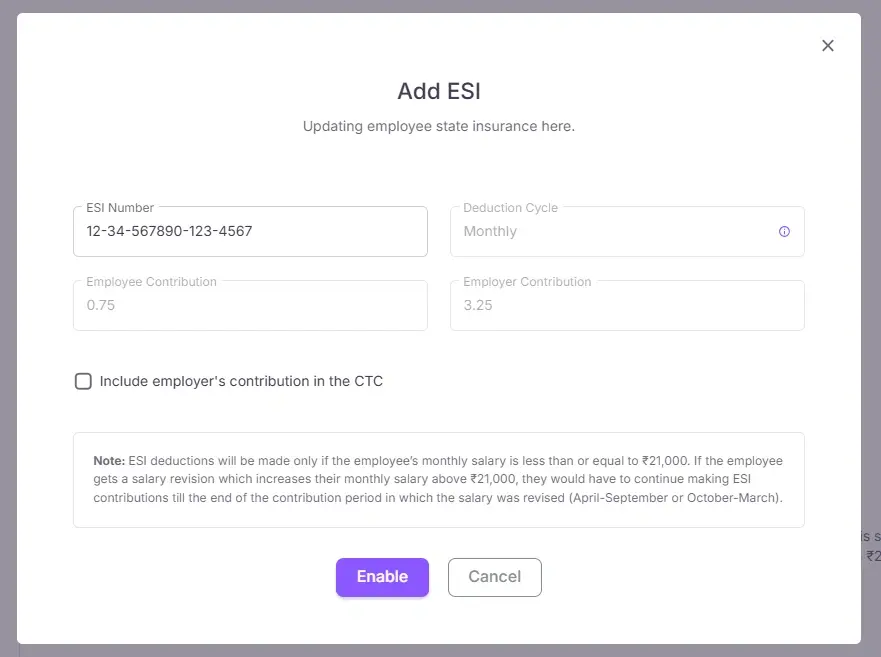

Setup ESI

Steps to enable ESI in payroll settings.

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Statutory Component Tab: Click the Statutory Component tab and select ESI from the sidebar.

- Enter your ESI Number: You can find this in the registration letter provided by the Employee State Insurance Corporation (ESIC).

- Include Employer’s Contribution in CTC: Select whether you want to include the employer’s contribution as part of employees’ CTC.

- Enable ESI: Click the Enable button to enable ESI.

Labour Welfare Fund (LWF)

LWF is a state-mandated fund to support employee welfare initiatives.

Guidelines for LWF

Rules and contributions applicable to LWF compliance.

- LWF is applicable based on state-specific rules .

- Both employers and employees contribute to the fund, typically on a monthly, quarterly, or half-yearly basis .

- LWF contributions vary by state and are used for education, health, and social security benefits for employees.

- Employers must register under the respective State Labour Welfare Board to comply with LWF regulations.

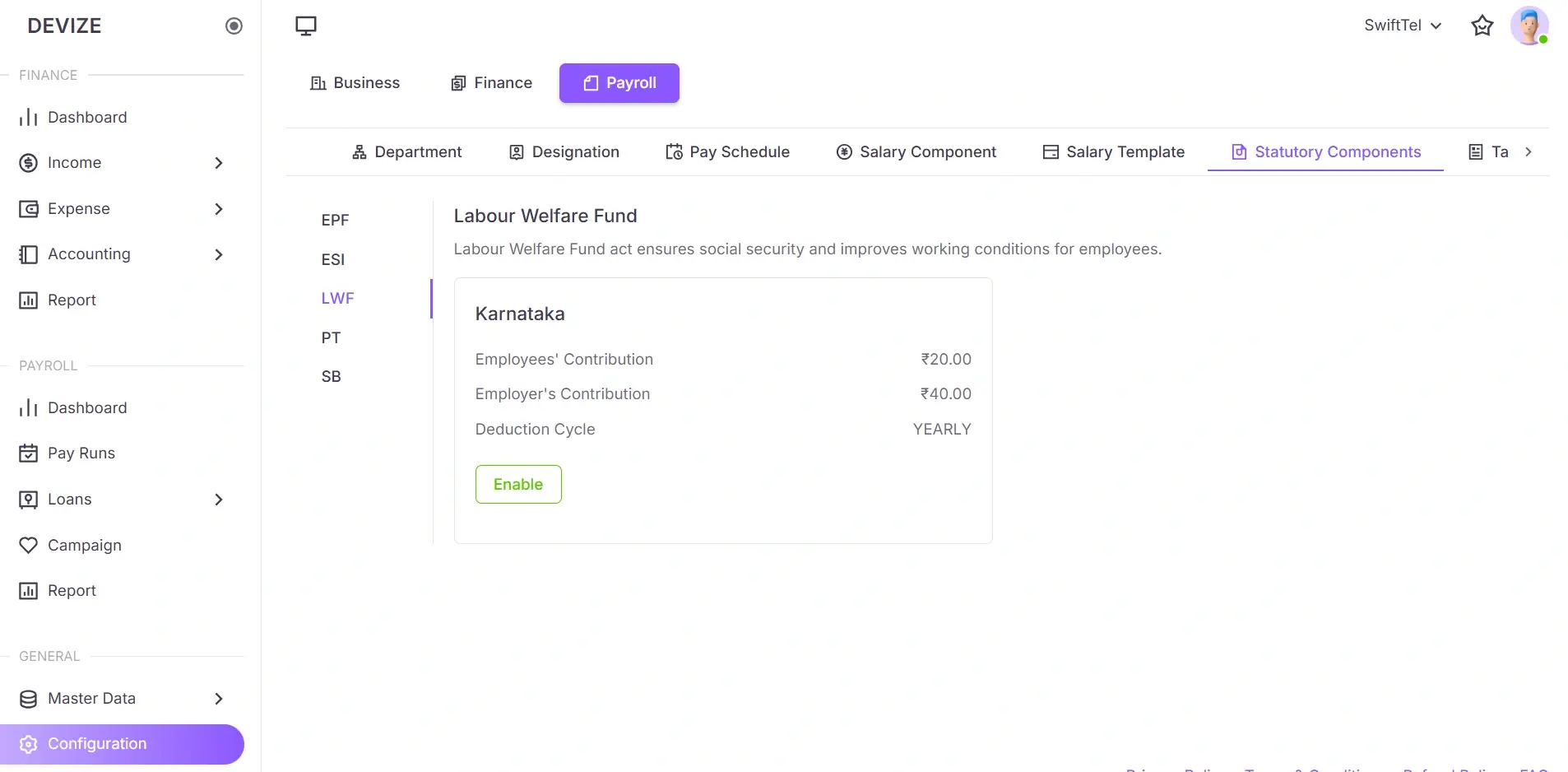

Setup LWF

Steps to enable LWF in payroll settings.

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Statutory Component Tab: Click the Statutory Component tab and select LWF from the sidebar.

- Enable LWF: Click the Enable button to activate LWF deductions.

Professional Tax (PT)

PT is a state-levied tax on professionals based on salary slabs.

Guidelines for PT

Tax slab details and deduction criteria.

- Rates vary by state, with monthly or annual deductions.

- Applicable to salaried employees, professionals, and business owners in certain states.

- Deduction amounts depend on salary slabs set by the respective state government.

- Employers are responsible for deducting PT from employee salaries and remitting it to the state.

- Failure to comply with PT regulations may result in penalties and interest charges.

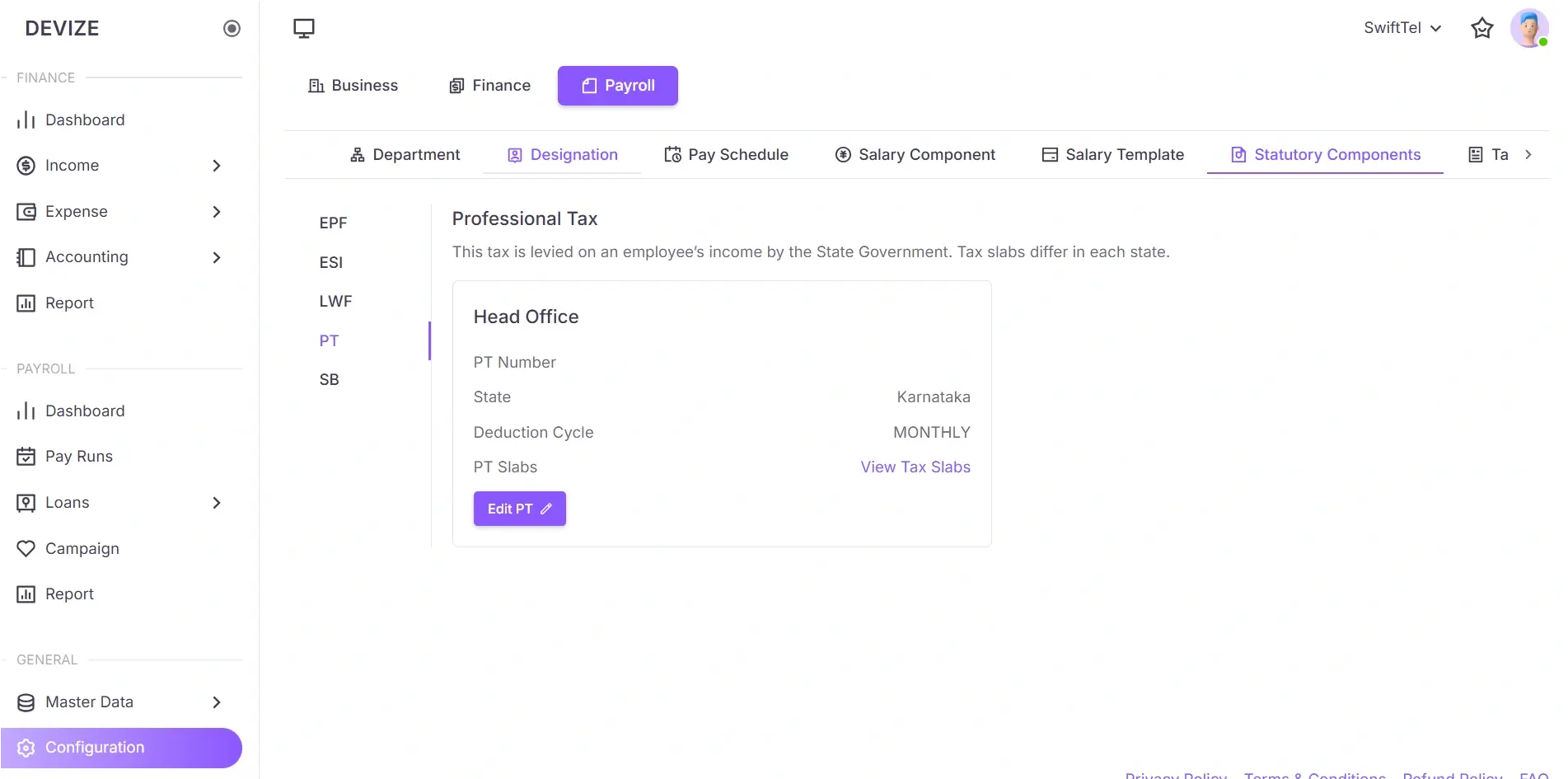

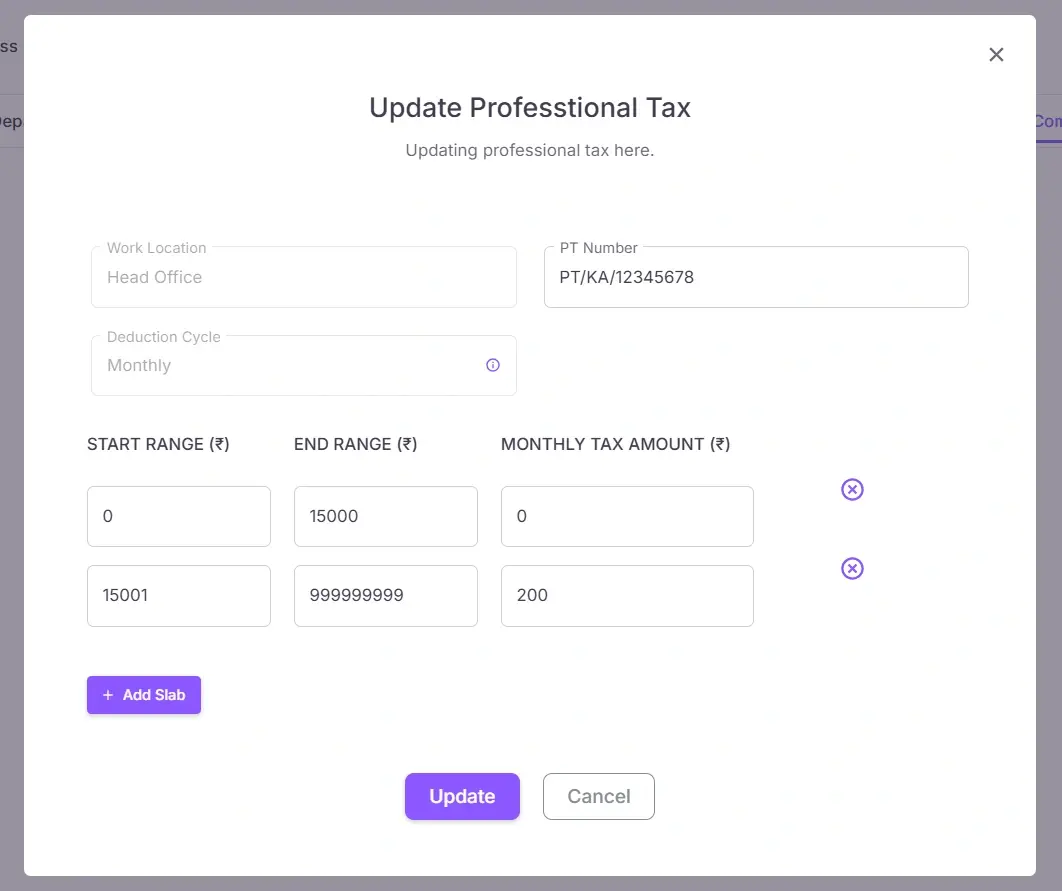

Setup PT

Steps to enable PT in payroll settings.

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Statutory Component Tab: Click the Statutory Component tab and select PT from the sidebar.

- Click Edit PT Button: In the PT section, click Edit PT to open the Professional Tax update form, enter PT number and other fields.

- Add More Slabs (If Needed): Click + Add Slab to define additional tax brackets.

- Update PT Settings: Click the Update button to save changes.

Statutory Bonus (SB)

SB is a legally mandated bonus for eligible employees based on company profitability.

Guidelines for SB

Bonus eligibility and percentage details.

- Employees earning below a specified limit are entitled to an annual bonus of 8.33% to 20% of salary.

- The minimum bonus is 8.33% of the salary , even if the company makes no profit.

- The maximum bonus payable is 20% of the salary , depending on company profitability.

- Only employees who have worked for at least 30 days in a financial year are eligible.

- Bonus payments must be made within eight months from the end of the financial year.

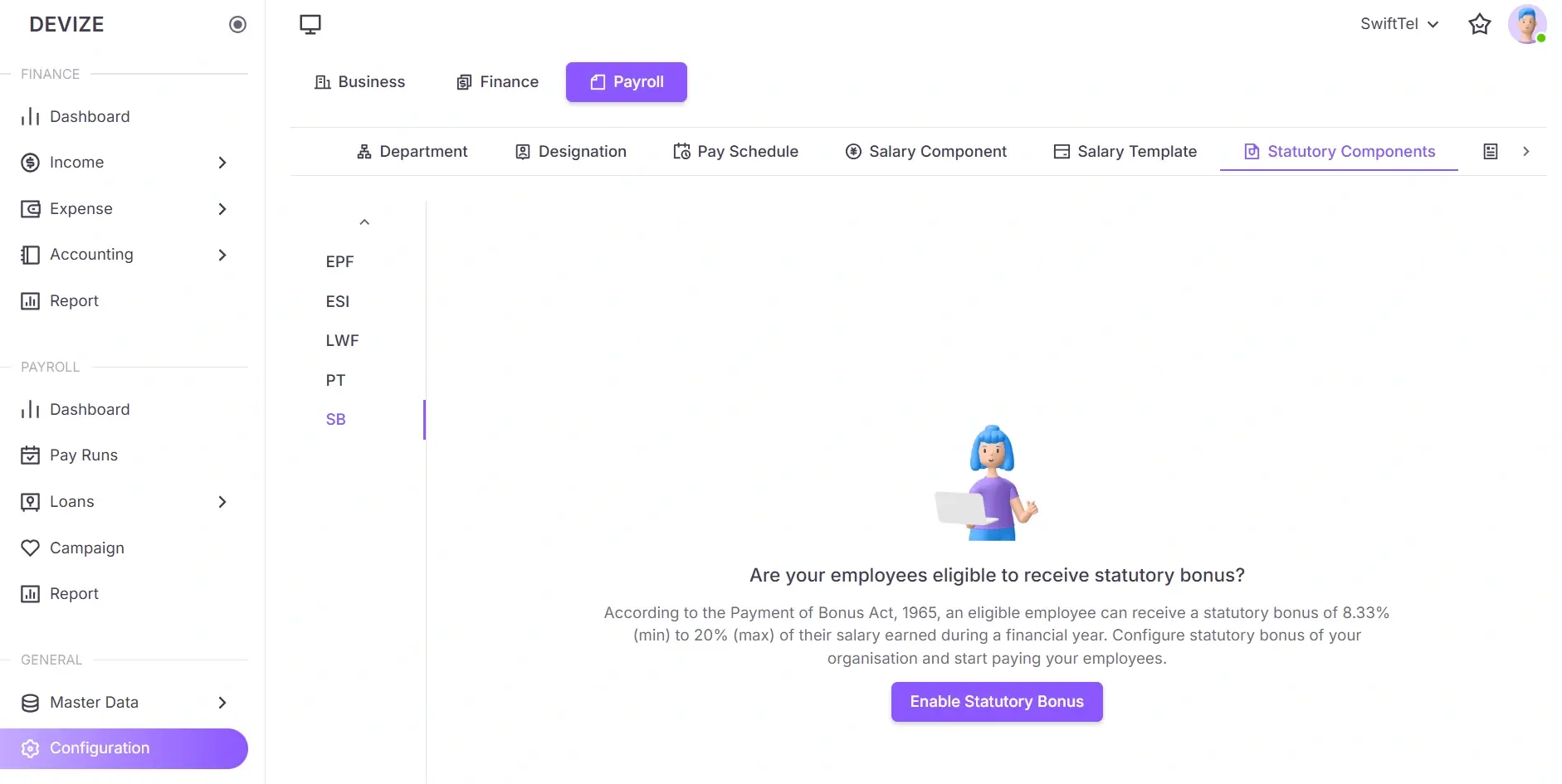

Setup SB

Steps to enable SB in payroll settings.

- Navigate to Configuration Page: From the left sidebar, select Configuration to redirect to the configuration page.

- Open Payroll Tab: Click the Payroll tab to proceed.

- Open Statutory Component Tab: Click the Statutory Component tab and select SB from the sidebar.

- Click Enable Statutory Bonus Button: In the SB section, click Enable Statutory to enable statutory bonus

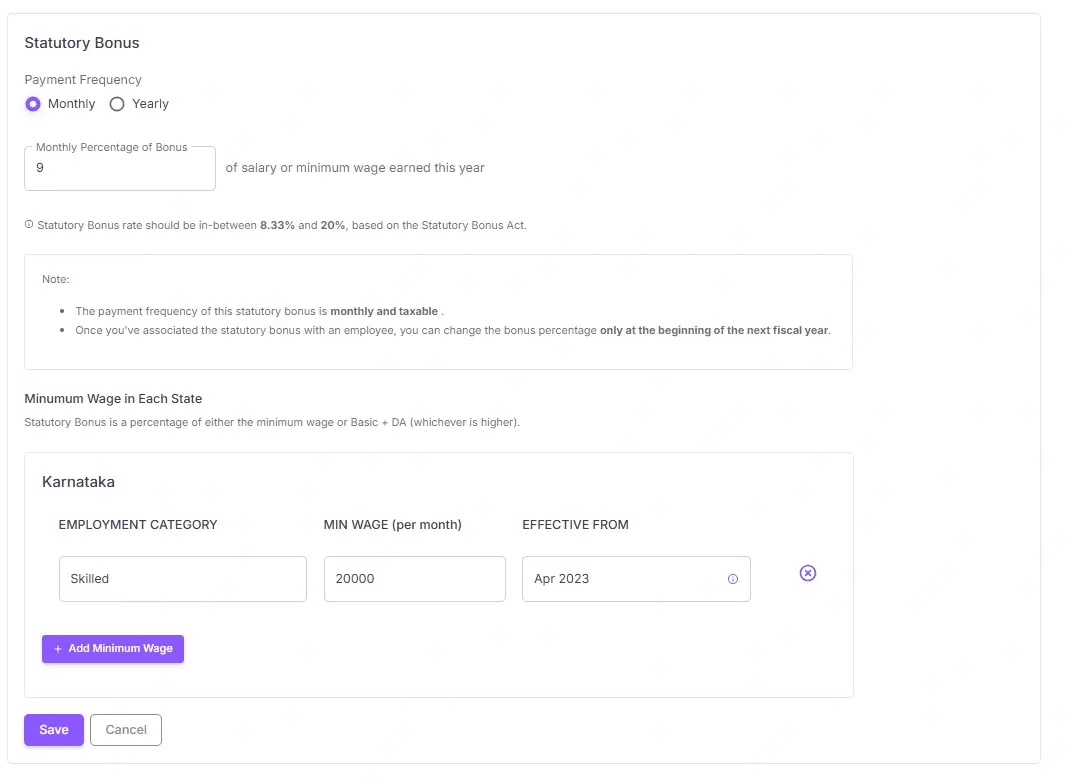

- Select the Payment Frequency: Choose between Monthly or Yearly payment frequency.

- Enter the Percentage of Bonus: Set a value between 8.33% and 20%.

- Set Minimum Wage for Each State: For the states your organisation operates in, you can set the minimum wage by clicking + Add Minimum Wage.

- Click Save: Once all details are configured, click the Save button to apply the changes.

| Name | Description |

|---|---|

| EPF | Retirement benefit where both employer and employee contribute a fixed percentage. |

| ESI | Health and disability insurance for employees under a wage threshold. |

| LWF | State-mandated welfare fund for employees. |

| PT | State-levied tax on professionals based on salary. |

| SB | Mandatory annual bonus for eligible employees. |