Documents

- Getting Started

- My Plan

- Personalization

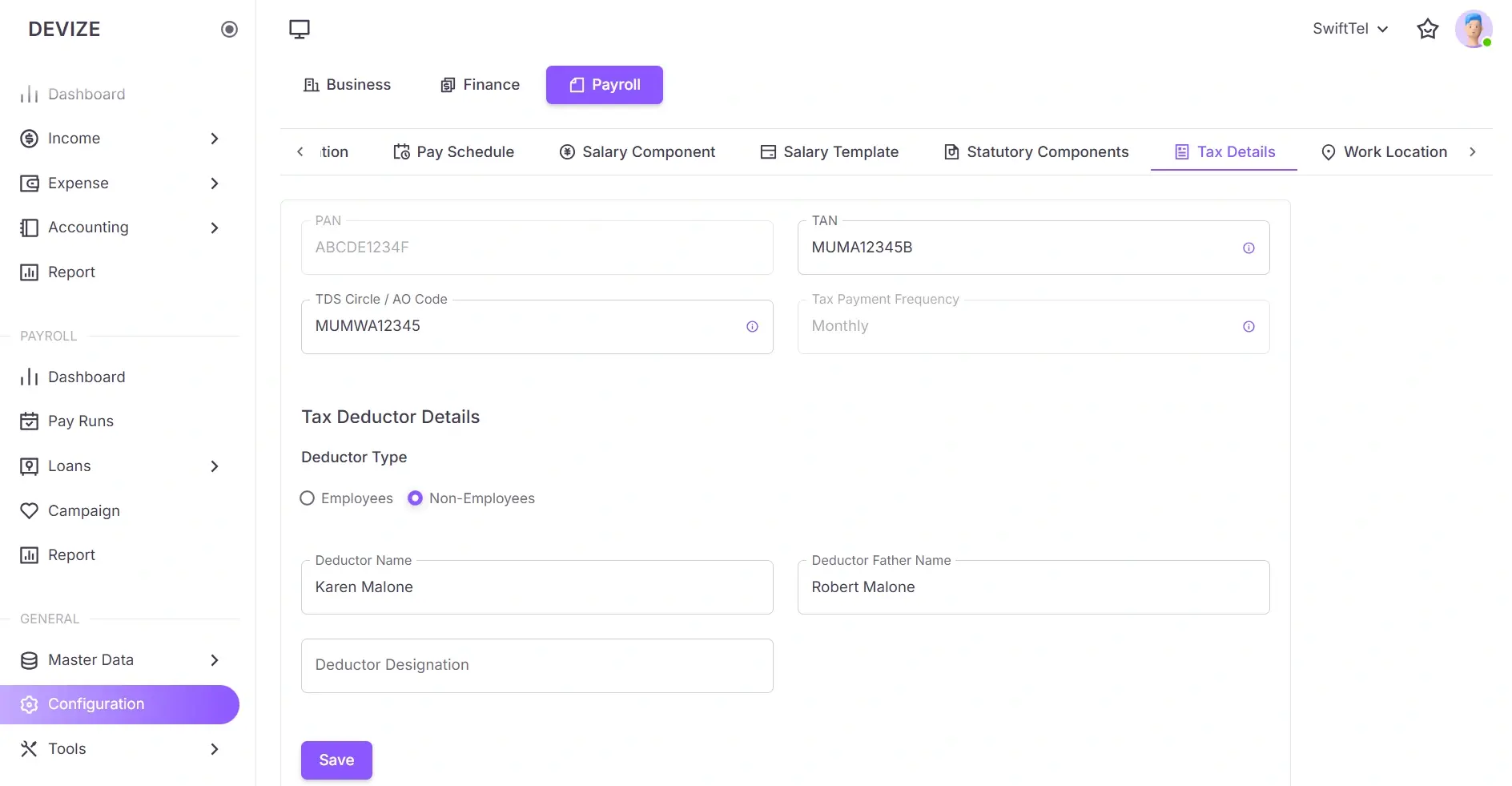

Setup Tax Details

Tax details are essential for compliance and payroll processing. They include important identifiers like PAN and TAN, tax payment frequency, and deductor information.

Setting Up Tax Details

Follow these steps to configure tax details:

- Navigate to Payroll Page: From the left sidebar, select Payroll to access payroll settings.

- Open Tax Details Tab: Click the Tax Details tab to proceed with tax setup.

- Enter values: Provide values for corresponding fields.

- Save the Details: Click the Save button to finalize the tax setup.

| Name | Description |

|---|---|

| PAN | Permanent Account Number for tax identification. |

| TAN | Tax Deduction and Collection Account Number. |

| TDS Circle / AO Code | The Tax Deduction and Collection circle and Assessing Officer code. |

| Tax Payment Frequency | Defines how often tax payments are made. |

| Deductor Type | Specifies whether the tax deductor applies to Employees or Non-Employees. |

| Deductor Name | The name of the tax deductor. |

| Deductor Father Name | The father’s name of the tax deductor. |

On this page